Find out what's next... Read the blog

Full control over your digital assets

Threshold provides a suite of threshold cryptography services that power user sovereignty on the blockchain.

Get Started

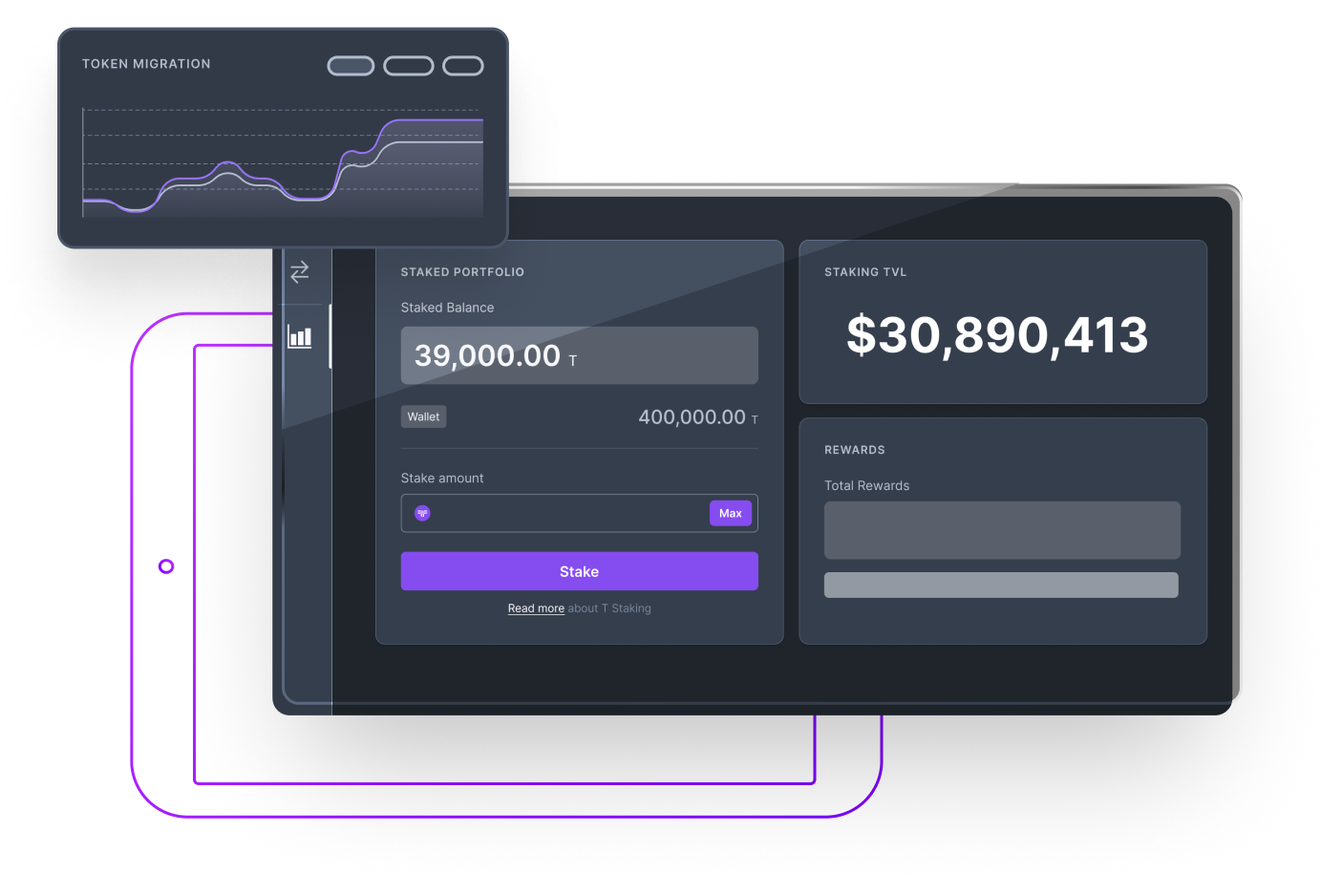

Threshold Staking

Stakers escrow T tokens to run a node on the Threshold Network and earn rewards.

Get Started

Provide Liquidity

Liquidity providers earn yields by depositing assets into liquidity pools.

Get Started

Bridge BTC to Ethereum

tBTC is Threshold’s decentralized bridge to bring BTC to the Ethereum network.

Get Started

Token Holder DAO

Make the most of your T tokens on the Threshold Network by participating in DAO governance.

There’s a role for everyone. Take this brief quiz and see which Threshold opportunity fits you best.

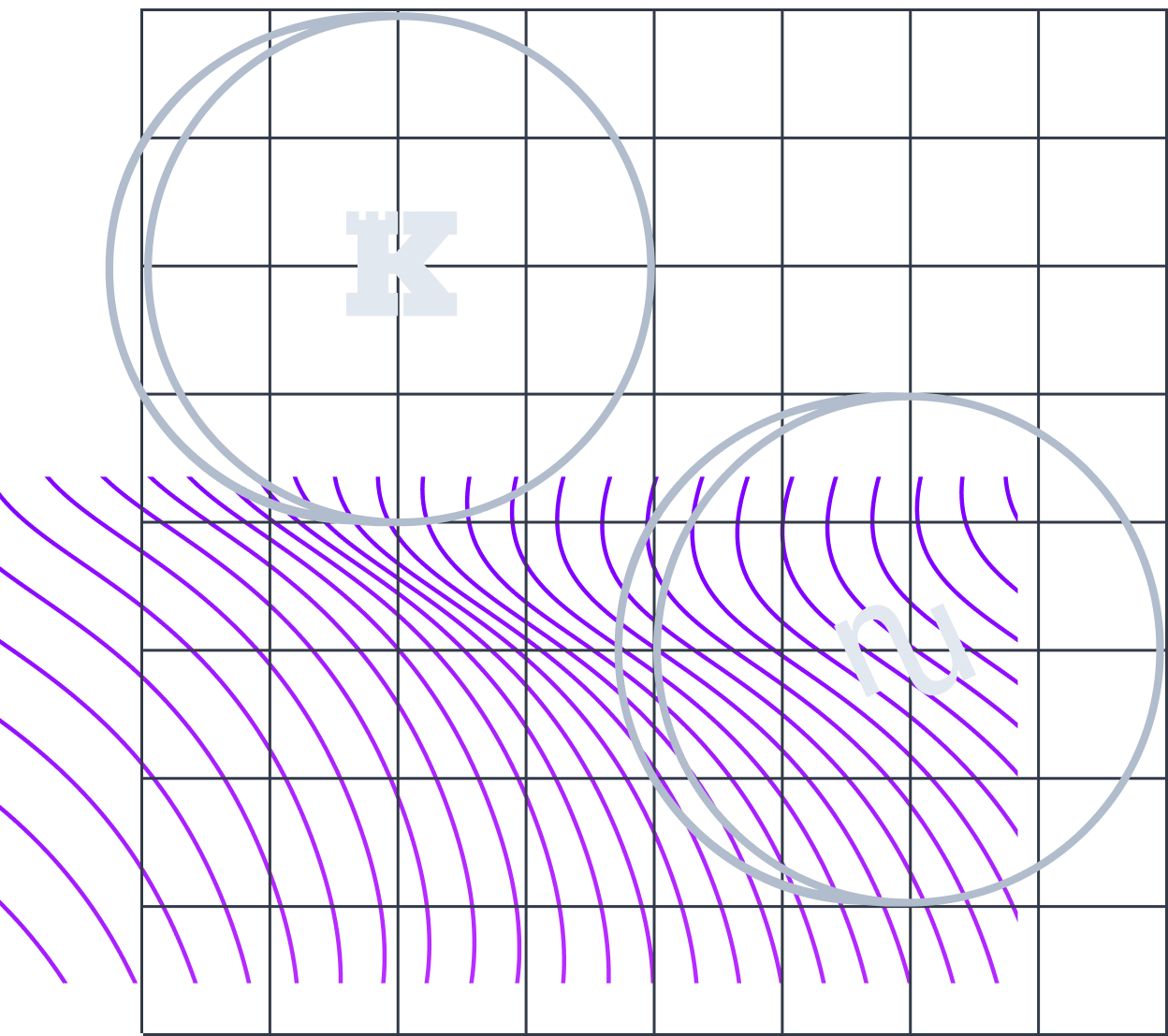

Do you own KEEP or NU?

Keep and NuCypher merged to form the Threshold Network. Migrate your tokens to T!

Harness the power of Threshold

Threshold leverages threshold cryptography to protect digital assets by distributing operations across independent parties, requiring some threshold number of them (t-of-n) to cooperate.

Decentralized

Threshold utilizes a network of independent nodes to provide threshold cryptographic services without a central authority.

Secure

Splitting cryptographic operations across nodes increases security and availability and reduces trust assumptions. Threshold is audited by the best firms in the space.

Private

Cryptographic protocols eradicate the trust burden forced on end-users and ensure privacy on the public blockchain.

Threshold is run by an active community.

The Threshold DAO is a decentralized community of T token holders and their delegates who collectively vote to decide what's next for the network.

Current Proposals

Proposal: 12-month Budget for Treasury Guild

May 2022 · jakelynch

Interim Era Incentive Schemes: (1) One-off Migration+Stake Bonus & (2) Ongoing Stable Yield

Apr 2022 · arj

Threshold Network’s participation in Binance Learn & Earn 2.0 campaign

Mar 2022 · Sienna