Maximize your BTC in DeFi. Mint tBTC now

Bridge your Bitcoin and start earning.

Deposit and redeem BTC in DeFi without intermediaries using Threshold's tBTC.

0.00

btc

tBTC TVL

0

tBTC unique address

$0

Staking TVL

Get Started

Build uncensorable e2ee into your dapp

TACo is the only end-to-end encryption plugin that is end-to-end decentralized

Easy to integrate

TACo makes access control easy with an intuitive API, flexible architecture, and a free-to-use Testnet. All you need is a use case that involves private data, and where trusting an intermediary won't fly.

Day One Decentralized

Access to data encrypted via TACo is managed by groups of independent Threshold nodes, from the very first byte. There's no 'temporary phase' where you trust the developers not to decrypt sensitive data.

Secure & redundant

Access control groups are sampled from a live, battle-tested & well-collateralized network. TACo is being integrated into apps handling hyper-sensitive payloads like seed phrases & health data.

Get Started

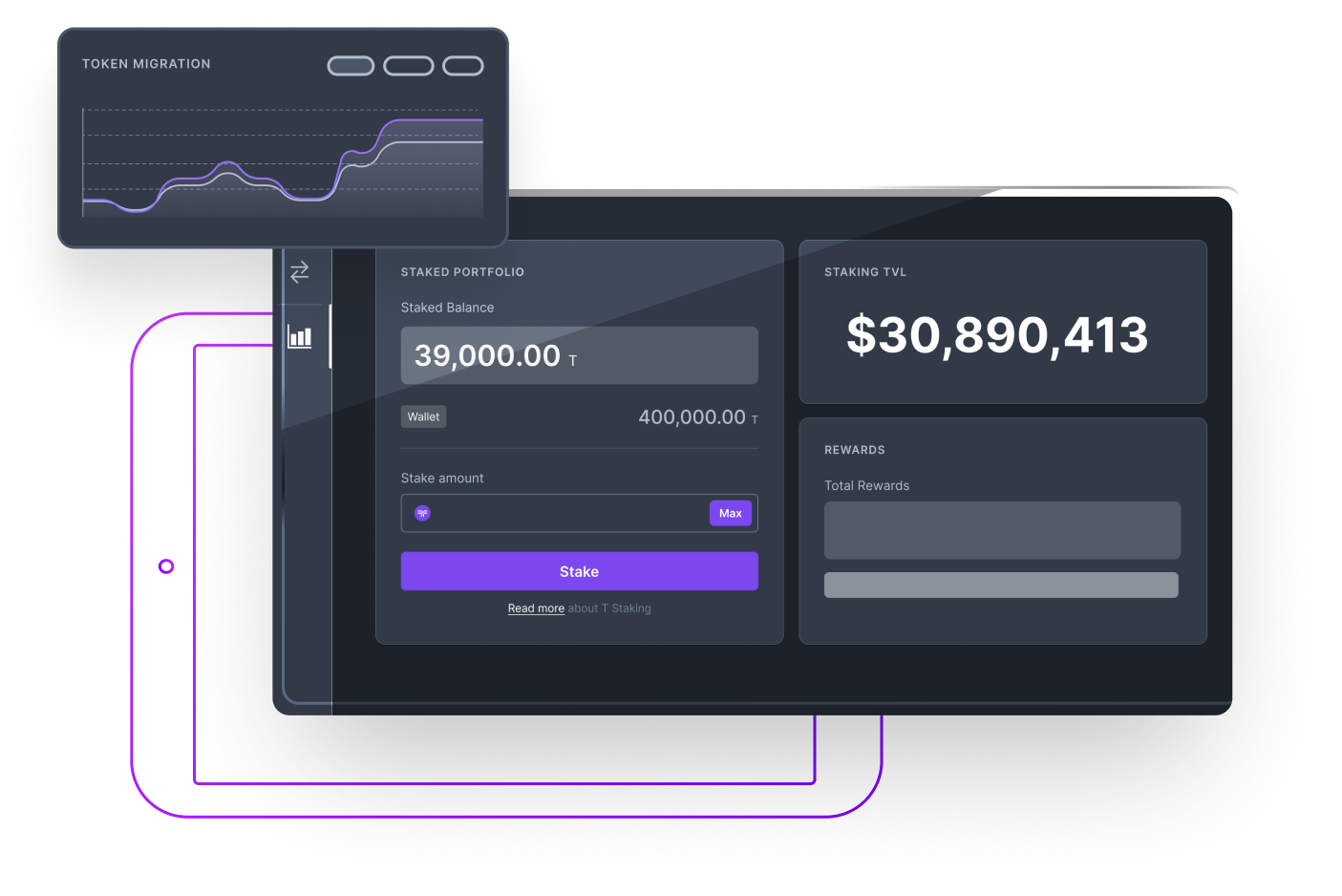

Threshold Staking

Stakers escrow T tokens to run a node on the Threshold Network and earn rewards.

Get Started

Provide Liquidity

Liquidity providers earn yields by depositing assets into liquidity pools.

Get Started

Token Holder DAO

Make the most of your T tokens on the Threshold Network by participating in DAO governance.

Do you own KEEP or NU?

Keep and NuCypher merged to form the Threshold Network. Upgrade your tokens to T!

Get Started

Harness the power of Threshold

Threshold leverages threshold cryptography to protect digital assets by distributing operations across independent parties, requiring some threshold number of them (t-of-n) to cooperate.

Decentralized

Threshold utilizes a network of independent nodes to provide threshold cryptographic services without a central authority.

Secure

Splitting cryptographic operations across nodes increases security and availability and reduces trust assumptions. Threshold is audited by the best firms in the space.

Private

Cryptographic protocols eradicate the trust burden forced on end-users and ensure privacy on the public blockchain.

Threshold is run by an active community.

The Threshold DAO is a decentralized community of T token holders and their delegates who collectively vote to decide what's next for the network.

Current Proposals

TIP-076: SATS: Bitcoin Standard for GameFi, bring Satoshi home

Feb 2024 · juminoz

TIP-077 Fund request to Threshold Pool: every holders can stake T

Apr 2024 · delightlabs_io

TIP-067 Part 2 - Add Community Nodes to Beta Staker Program

Dec 2023 · sap