TIP 46: Defi Liquidity Bootstrap and Growth Part I - Market Maker

Mar 2023 · sensecapital

**Vote Type:**

Token holder DAO Governor Bravo Proposal

**DAO Elected Representative Sponsor:**

Will

**Overview:**

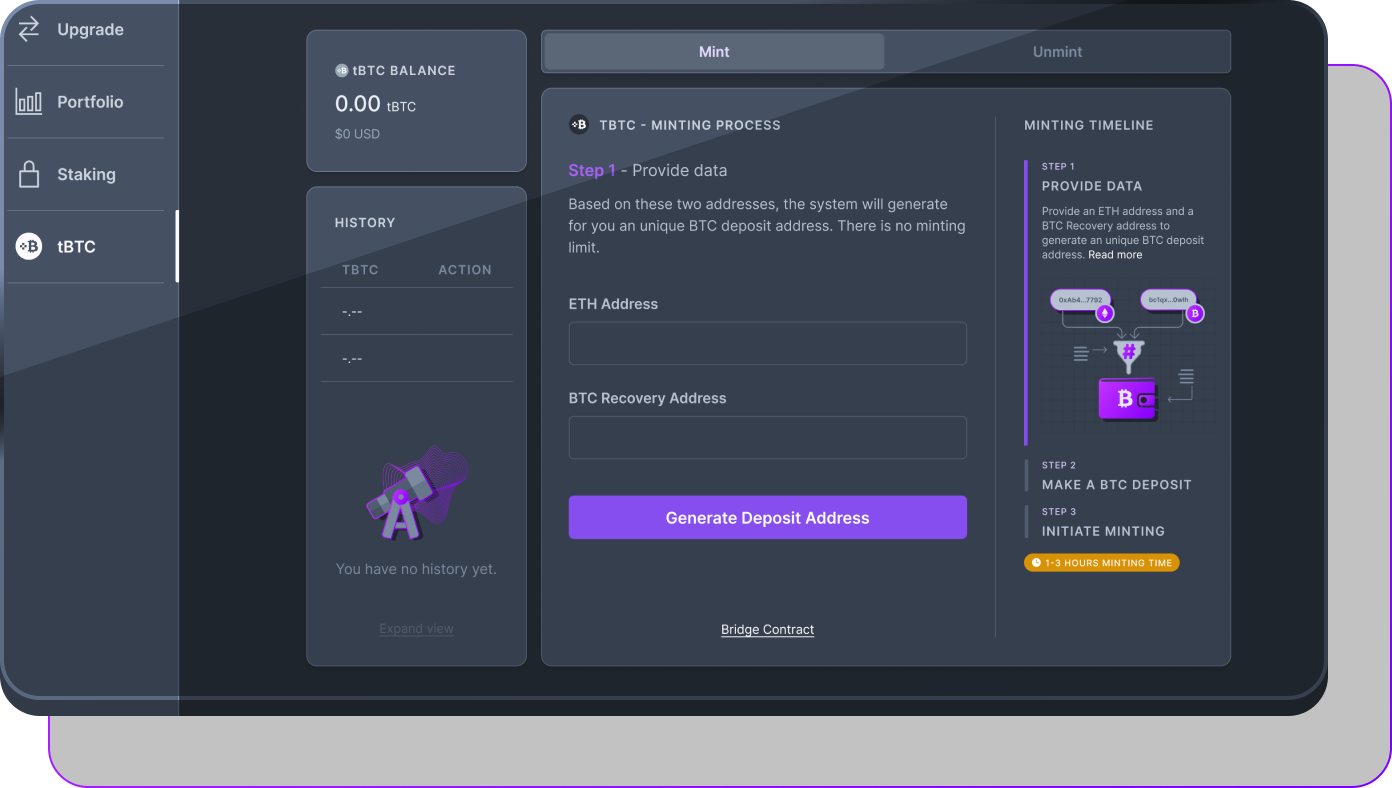

tBTC has successfully launched, but with limited utility, adoption at scale is currently bottlenecked. We need to establish tBTC use cases beyond the core BTC to ETH bridge. To do that, a solid liquidity foundation anchored around tBTC TVL and volume on DeFi needs to be built.

This is a proposal for the Threshold DAO to engage with a Sense Capital to deliver market making services to bootstrap liquidity for tBTC across the DeFi ecosystem.

Further details including services rendered and benefits to the DAO are included in the Detailed Summary section of this proposal.

**Milestones and Deadlines:**

* Commencement: Focus liquidity deployment, inventory rebalance and tweak and deploy smart contract based trading and concentrated liquidity management.

* Ramp up (month 1): Increase volume and liquidity via V3 LP strategy and Dex arbitrage on mainnet, expand to additional L2s like Polygon and Optimism.

* Growth (month 6 - 12): Grow volume with refined strategy.

**Who Is Involved:**

Sense Capital, Threshold Token Holder DAO, Threshold Treasury Guild

**Detailed Summary:**

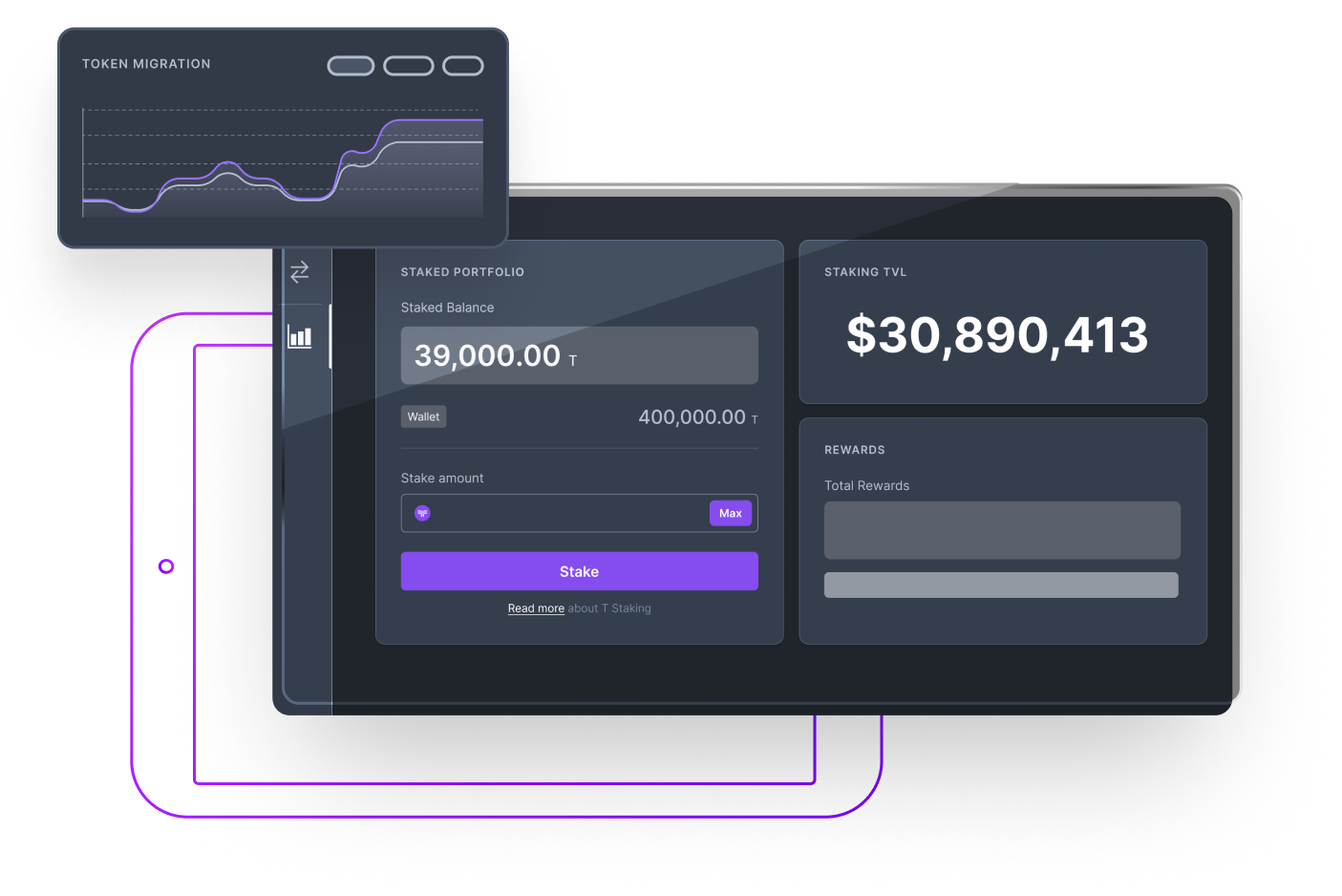

This proposal calls for a 50m T loan to be given to Sense Capital from the Threshold DAO to be paid back in a basket of ETH based crypto assets potentially including stables and ETH.

In addition to market making services Sense Capital will provide monthly reports on progress to the Threshold Treasury Guild.

Other than executing the loan and monitoring performance of the engagement this proposal requires no further action on behalf of the Threshold DAO.

**Who Is Sense Capital?**

Bespoke trading firm based in Hong Kong/Australia, Market Making, Liquidity management on CEX/DEX since 2019. Focus on 3 apex assets like Bitcoin, ETH and Stablecoins.

Advocate and early user of MakerDAO/Uniswap with strong Defi trading capabilities including automated Uniswap V3 liquidity management, cross DEX/CEX arbitrage based on our Defi orderflow and MEV data research.

**Market Making Goals:**

Make tBTC a dominant, trusted, distributed Bitcoin Representation on Defi, accessible / redeemable to Real BTC:

* Bootstrap: Liquidity with Organic Defi Flywheel

* Scale: AUM with large pockets with Unique value prop for each segment (exchange, mm, traders, miners)

* Expand: Build out channels and rails (wallet, exchange, dapp, payment processors)

**Key objectives**

* Boost Defi trading volume on DEXes like Uniswap and Curve with concentrated liquidity deployment and MEV Arbitrage engine.

* Increase sustainable yield generated for LP to incentivise liquidity growth in liquidity pools.

* Improve user experience of liquidity to offer better depth and execution price on Dex liquidity pools.

**Why this deal?**

* Partnering with a DeFi focused market maker like Sense helps us lay the groundwork to attract tBTC DeFi Liquidity.

* 50M T loan is a small price for this level of sophistication and in the trenches work is required to bootstrap tBTC. For comparison other firms asked for 200-300m T loan and only want to work on market making for T and on CeFi.

* Sense is sensitive to T liquidity supply/demand market dynamics and has already laid out a calculated approach to minimize the supply impact when swapping T for ETH/BTC/stables (per the proposal). Post engagement, Sense Cap is flexible to pay back the loan back to the DAO in ETH/BTC/stables and/or T to aid in treasury diversification efforts.

Tx Details (If required):

Additional Info (Optional):

T inventory would transfer over 3 stages.

|Stages||T Inventory|Objectives|

| --- | --- | --- | --- |

|1|Commencement|10M|Rebalance T inventory, setup mainnet and arbitrum trading, data collection.|

|2|Ramp up

After 1-month from commencement.|15M|Increase volume and liquidity via V3 LP strategy and Dex arbitrage on mainnet, expand to additional L2s like Polygon and Optimism|

|3|Growth

After 6-month from commencement or KPI trigger|25M|Grow volume with refined strategy.

KPI Trigger

- Total Defi TVL exceeds 2000 tBTC

- Daily trade volume exceeds $1M USD for 3 days (less TVL but higher yield and velocity)

- DEX TVL increased $10M USD (excluding current Uniswap/Curve TVL)|

Request Mint fee rebate in T token during stage 1, 2 to lower the cost of operation, a list of mint transaction id would be provided at the end of stage 2 for reimbursement.

Example: Initial use of T token inventory at commencement.

Passively rebalance 50% of first trench into Stable, ETH, Bitcoin over 2 weeks without price impact or supply shock. Current daily trading volume is $35M/day, passive rebalance would have negligible impact ($500/hour)